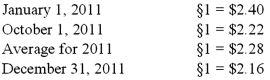

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2011 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2012. A building was then purchased for §170,000 on January 1, 2011. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2011. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:

Prepare a balance sheet for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Definitions:

LLC

A limited liability company, which is a business structure in the US that offers its owners (members) protection from personal liability for its debts and obligations.

Plan of Merger

A detailed document that outlines the proposed merging of two or more companies into one entity.

LLC Assets

Properties, financial assets, and physical items owned by a Limited Liability Company that are used for the business's operations.

Limited Partners

Investors in a partnership who are not involved in the day-to-day operations of the business and whose liability is limited to the amount of their investment.

Q11: Pell Company acquires 80% of Demers Company

Q42: Stiller Company, an 80% owned subsidiary of

Q43: Boerkian Co. started 2011 with two assets:

Q44: Pell Company acquires 80% of Demers Company

Q46: Which of the following is not an

Q49: The Henry, Isaac, and Jacobs partnership was

Q56: The balance sheet of Rogers, Dennis &

Q68: If a subsidiary is operating in a

Q102: The balance sheets of Butler, Inc. and

Q105: Which of the following is not an