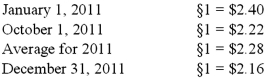

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2011 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2012. A building was then purchased for §170,000 on January 1, 2011. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2011. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:

Prepare a statement of cash flows for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Definitions:

Psychology

The scientific study of the mind and behavior, encompassing various disciplines related to human mental functions and interactions.

Major Elements

Key components or essential parts that constitute a system, structure, or set of ideas.

Humanistic Approach

A perspective in psychology that emphasizes the study of the whole person and the uniqueness of each individual's experience.

Seize The Day

A phrase encouraging individuals to make the most of the present moment without concern for the future, often associated with the Latin term "carpe diem."

Q11: What events or circumstances might force the

Q13: Under the temporal method, how would cost

Q25: When taking a phone call without explanation

Q26: Illustrate and label a typical company structure,

Q27: When making a phone call you should

Q28: How do the balance sheet and statement

Q74: Withdrawals from the partnership capital accounts are

Q90: How is the gain on an intra-entity

Q91: How can a parent corporation determine the

Q109: Panton, Inc. acquired 18,000 shares of Glotfelty