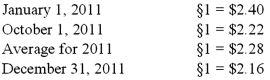

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2011 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2012. A building was then purchased for §170,000 on January 1, 2011. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2011. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:

Prepare a balance sheet for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Definitions:

Abstract-Reasoning Skills

The skill to examine data, identify trends and links, and address issues at a sophisticated, conceptual stage.

Social-Cultural Perspective

An approach in psychology that examines how social, cultural, and environmental variables influence individuals' behavior and thought processes.

Group Membership

Belonging to a social group and identifying as a member of it, which can influence one's behavior, attitudes, and perceptions of others.

Individual Attitudes

Personal evaluations, feelings, or opinions toward objects, people, or events, which can influence behavior and choices.

Q1: Westmore, Ltd. is a British subsidiary of

Q34: Strickland Company sells inventory to its parent,

Q39: What are the five types of governmental

Q40: A local partnership has assets of cash

Q54: Prince Corp. owned 80% of Kile Corp.'s

Q61: The Town of Anthrop has recorded the

Q70: MacHeath Inc. bought 60% of the outstanding

Q88: When leaving a voice mail message<br>A) State

Q90: Coyote Corp. (a U.S. company in Texas)

Q114: Pell Company acquires 80% of Demers Company