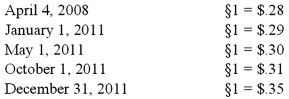

Boerkian Co. started 2011 with two assets: Cash of §26,000 (Stickles) and Land that originally cost §72,000 when acquired on April 4, 2008. On May 1, 2011, the company rendered services to a customer for §36,000, an amount immediately paid in cash. On October 1, 2011, the company incurred an operating expense of §22,000 that was immediately paid. No other transactions occurred during the year so an average exchange rate is not necessary. Currency exchange rates were as follows:

Assume Boerkian was a foreign subsidiary of a U.S. multinational company and the U.S. dollar was the functional currency of the subsidiary. Prepare a schedule of changes in the net monetary assets of Boerkian for the year 2011 and properly label the resulting gain or loss.

Definitions:

Account Balance

The difference between the debits and credits recorded in an account.

Financial Statement

A precise documentation of monetary activities and the financial state of a corporation, a person, or another entity.

Account Balance

The total amount of money that is present in an account at any given time, which can be a positive or negative value.

Financial Statement

An official document detailing the financial transactions and status of an entity, such as a company, person, or organization, often comprising the balance sheet, income statement, and statement of cash flows.

Q7: Salaries and wages that have been earned

Q27: When a city received a federal grant

Q38: Thomas Inc. had the following stockholders' equity

Q47: Quadros Inc., a Portuguese firm was acquired

Q71: Donald, Anne, and Todd have the following

Q77: Belsen purchased inventory on December 1, 2010.

Q81: McGuire Company acquired 90 percent of Hogan

Q91: How can a parent corporation determine the

Q95: During 2011, Parent Corporation purchased at book

Q105: Which of the following is not an