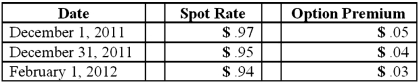

On December 1, 2011, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD) . Collection of the receivable is due on February 1, 2012. Keenan purchased a foreign currency put option with a strike price of $.97 (U.S.) on December 1, 2011. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow:

Compute the fair value of the foreign currency option at December 1, 2011.

Definitions:

Misplaced File

A document or electronic file that is not in its correct or designated location, potentially leading to inefficiency or loss of information.

Reconstruct

To rebuild something that has been damaged or destroyed back to its original state.

Original Documents

The authentic, first-generation documents or records, not reproductions or copies.

Charismatic

Possessing a compelling charm or appeal that inspires devotion or attraction in others.

Q13: As of January 1, 2011, the partnership

Q20: Primo Inc., a U.S. company, ordered parts

Q25: Kennedy Company acquired all of the outstanding

Q36: Pigskin Co., a U.S. corporation, sold inventory

Q52: When Jolt Co. acquired 75% of the

Q69: What is meant by unrealized inventory gains,

Q70: Quadros Inc., a Portuguese firm was acquired

Q85: The following information has been taken from

Q97: On January 1, 2011, Bast Co. had

Q107: On January 1, 2009, Nichols Company acquired