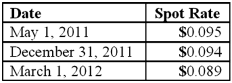

On May 1, 2011, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2012. On May 1, 2011, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2012 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2011. The following spot exchange rates apply:

Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the impact on Mosby's 2012 net income as a result of this fair value hedge of a firm commitment?

Definitions:

Nonmetals

Elements that lack metallic properties and are typically poor conductors of heat and electricity.

Human Right

A right that is believed to belong justifiably to every person, encompassing basic freedoms and protections that should be upheld by all societies.

Security Laws

Regulations designed to protect investors, ensure fair market operations, and prevent financial frauds, governing the trade of stocks, bonds, and other securities.

Internet Growth

The rapid expansion of internet accessibility, usage, and technology developments, leading to widespread changes in communication, commerce, and information sharing globally.

Q31: What factors create a foreign exchange gain?

Q32: A local partnership has assets of cash

Q37: The following account balances were available for

Q42: These questions are based on the following

Q55: Kaye Company acquired 100% of Fiore Company

Q62: Under modified accrual accounting, when are expenditures

Q69: Racer Corp. acquired all of the common

Q82: McGuire Company acquired 90 percent of Hogan

Q86: On January 1, 2010, Palk Corp. and

Q91: Prevatt, Inc. owns 80% of Franklin Company.