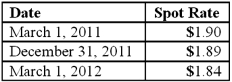

On March 1, 2011, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2012. On March 1, 2011, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2012 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2011. The following spot exchange rates apply:

Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the net impact on Mattie's 2011 income as a result of this fair value hedge of a firm commitment?

Definitions:

Principle

A fundamental truth, law, doctrine, or motivating force, upon which others are based or derived.

Relative Motion

The movement of an object in relation to another object, considering both of their movements in a specific frame of reference.

Shape Constancy

The sensory experience in which an object's observed shape stays the same, even when the perspective or distance from which it is seen changes.

Size Constancy

A perceptual phenomenon in which the perceived size of an object remains constant despite changes in the distance from which it is observed.

Q6: All of the following statements regarding the

Q7: A parent company owns a controlling interest

Q14: Skipen Corp. had the following stockholders' equity

Q15: Danbers Co. owned seventy-five percent of the

Q29: The partners of Donald, Chief & Berry

Q55: Woolsey Corporation, a U.S. company, expects to

Q98: On January 1, 2010, Cale Corp. paid

Q101: According to the FASB ASC regarding the

Q105: Which of the following is not an

Q109: Pell Company acquires 80% of Demers Company