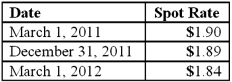

On March 1, 2011, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2012. On March 1, 2011, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2012 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2011. The following spot exchange rates apply:

Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Definitions:

Money Supply

The total amount of monetary assets available in an economy at a specific time, including cash, coins, and balances held in checking and savings accounts.

Glass-Steagall Act

A U.S. law enacted in 1933, designed to prevent commercial banks from engaging in investment banking, thereby protecting depositor funds from risky market investments.

Investment Banking

The sale of stocks and bonds for corporations.

Q2: On May 1, 2011, Mosby Company received

Q7: According to the GASB (Governmental Accounting Standards

Q24: Which statement is false regarding the Statement

Q26: On October 1, 2011, Jarvis Co. sold

Q28: How does a parent company account for

Q32: Fargus Corporation owned 51% of the voting

Q45: One company acquires another company in a

Q51: Tosco Co. paid $540,000 for 80% of

Q63: How is a non-controlling interest in the

Q81: On October 1, 2011, Jarvis Co. sold