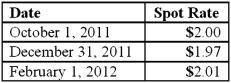

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:

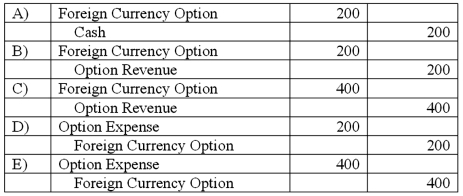

What journal entry should Eagle prepare on December 31, 2011?

Definitions:

Per-apple Tax

A hypothetical or specific form of taxation where a tax is levied on each unit of apple sold or consumed.

Imported Apples

Apples that are brought into a country from another country for sale, which can affect the local market in terms of prices, supply, and demand.

United States

A country located in North America, known for its significant economic, cultural, and political influence globally.

Maximum Price

A price ceiling set by authority to limit how high a price can be charged for a product or service.

Q12: Xygote, Yen, and Zen were partners who

Q26: How would consolidated earnings per share be

Q39: What are the five types of governmental

Q61: One company acquires another company in a

Q63: Carlson, Inc. owns 80 percent of Madrid,

Q74: McGuire Company acquired 90 percent of Hogan

Q78: Cleary, Wasser, and Nolan formed a partnership

Q78: Pell Company acquires 80% of Demers Company

Q99: Consolidated net income using the equity method

Q117: Under the partial equity method, the parent