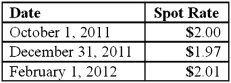

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:

What is the 2012 effect on net income as a result of these transactions?

Definitions:

Elevated Temperature

A body temperature that is higher than the normal range, often indicative of infection, inflammation, or other medical conditions.

Ambulatory Care

Medical care provided on an outpatient basis, including diagnosis, observation, consultation, treatment, intervention, and rehabilitation services.

Full-Thickness Tissue

Tissue damage extending through the entire depth of the skin, often requiring medical intervention for healing.

Traumatic Brain Injury

Physical damage to the brain tissue caused by an external mechanical force, potentially leading to temporary or permanent impairment of cognitive, physical, and psychosocial functions.

Q3: Fesler Inc. acquired all of the outstanding

Q32: A U.S. company buys merchandise from a

Q45: McGuire Company acquired 90 percent of Hogan

Q54: Peter, Roberts, and Dana have the following

Q72: Justings Co. owned 80% of Evana Corp.

Q85: Royce Co. acquired 60% of Park Co.

Q96: The following information has been taken from

Q104: When a parent uses the acquisition method

Q115: When a company applies the partial equity

Q118: Watkins, Inc. acquires all of the outstanding