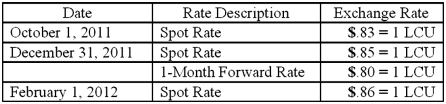

On October 1, 2011, Jarvis Co. sold inventory to a customer in a foreign country, denominated in 100,000 local currency units (LCU). Collection is expected in four months. On October 1, 2011, a forward exchange contract was acquired whereby Jarvis Co. was to pay 100,000 LCU in four months (on February 1, 2012) and receive $78,000 in U.S. dollars. The spot and forward rates for the LCU were as follows:

The company's borrowing rate is 12%. The present value factor for one month is .9901.

Any discount or premium on the contract is amortized using the straight-line method.

Assuming this is a fair value hedge; prepare journal entries for this sales transaction and forward contract.

Definitions:

Adoptive Parents

Adoptive parents are individuals who have legally taken on the responsibility of caring for and raising a child who is not biologically their own.

Biologically Related Siblings

Siblings who share the same biological parents and are genetically related to each other.

Personalities

Pertains to the distinct variations in the way individuals typically think, feel, and act.

Fraternal Twin Brothers

Siblings born at the same time who have developed from two different eggs fertilized by separate sperm, sharing about 50% of their genetic material.

Q18: Which item is not shown on the

Q22: On January 1, 2011, Riney Co. owned

Q41: Where is the disposition of a translation

Q53: Rojas Co. owned 7,000 shares (70%) of

Q54: On January 1, 2010, Jumper Co. acquired

Q62: Cleary, Wasser, and Nolan formed a partnership

Q65: Goehler, Inc. acquires all of the voting

Q66: A company has a discount on a

Q86: Assume the partnership of Howell, Madrid, and

Q88: Jansen Inc. acquired all of the outstanding