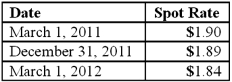

On March 1, 2011, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2012. On March 1, 2011, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2012 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2011. The following spot exchange rates apply:

Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the net impact on Mattie's 2011 income as a result of this fair value hedge of a firm commitment?

Definitions:

Alt-A Loans

Loans extended with little documentation or verification of the borrowers’ income, employment, and other indicators of their ability to repay. Because of this poor documentation, these loans are risky.

Economic Crisis

A situation where an economy faces a sudden downturn brought on by a financial crisis, resulting in high unemployment and inflation.

Foreclosure Rates

The frequency at which properties are forced to be sold due to the owner's failure to pay the mortgage.

Down Payment

An initial, upfront partial payment for the purchase of expensive items/services, typically associated with the purchase of a home or vehicle.

Q2: What financial schedule would be prepared for

Q4: Which of the following type of organization

Q6: Goehler, Inc. acquires all of the voting

Q15: McGuire Company acquired 90 percent of Hogan

Q42: Royce Co. acquired 60% of Park Co.

Q59: Gargiulo Company, a 90% owned subsidiary of

Q71: Perry Company acquires 100% of the stock

Q74: MacDonald, Inc. owns 80 percent of the

Q76: Pell Company acquires 80% of Demers Company

Q113: Which of the following will result in