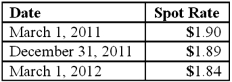

On March 1, 2011, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2012. On March 1, 2011, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2012 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2011. The following spot exchange rates apply:

Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the net impact on Mattie's 2012 income as a result of this fair value hedge of a firm commitment?

Definitions:

Intervention

An action or process of intervening, often implemented to bring about a change or influence the outcome in a positive way.

Chi-Square Test Statistic

A value calculated during a Chi-Square Test that measures the difference between observed and expected frequencies, used to assess the evidence against a null hypothesis.

One-Sample Test

A statistical test used to determine if the mean of a single sample differs significantly from a known or hypothesized population mean.

Variance

A measure of dispersion that represents the average of the squared differences from the mean.

Q12: Prince Company acquires Duchess, Inc. on January

Q12: Meisner Co. ordered parts costing §100,000 for

Q29: Franklin Corporation owns 90 percent of the

Q29: Which of the following is a financial

Q38: Thomas Inc. had the following stockholders' equity

Q47: Fesler Inc. acquired all of the outstanding

Q48: On January 1, 2010, Smeder Company, an

Q52: Under the partial equity method of accounting

Q83: Brisco Bricks purchases raw material from its

Q95: Stiller Company, an 80% owned subsidiary of