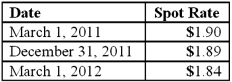

On March 1, 2011, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2012. On March 1, 2011, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2012 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2011. The following spot exchange rates apply:

Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Definitions:

Hierarchical

A system in which people or groups are ranked one above the other according to status or authority.

Initiative

the ability to assess and initiate things independently, often leading to new ideas or actions without being directed.

Organizational Stakeholders

Individuals or groups that have an interest or stake in the success and operations of an organization, including employees, customers, and shareholders.

Business Interests

Refer to the goals, objectives, or areas of focus that a business seeks to pursue or achieve for its growth and sustainability.

Q9: Max, Jones and Waters shared profits and

Q13: What are the three broad sections of

Q22: Gaw Produce Company purchased inventory from a

Q25: When taking a phone call without explanation

Q37: Stark Company, a 90% owned subsidiary of

Q42: On January 1, 2010, Cale Corp. paid

Q58: The ABCD Partnership has the following balance

Q70: How do intra-entity sales of inventory affect

Q80: Parent Corporation loaned money to its subsidiary

Q84: Which of the following approaches is used