These questions are based on the following information and should be viewed as independent situations.

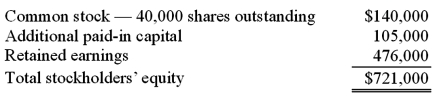

Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2009, when Cocker had the following stockholders' equity accounts.

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2012.

On January 1, 2012, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.

On January 1, 2012, Cocker issued 10,000 additional shares of common stock for $35 per share. Popper acquired 8,000 of these shares. How would this transaction affect the additional paid-in capital of the parent company?

Definitions:

Membership Approval

The process through which applicants are accepted as members of a group, organization, or club, often following specific criteria for admission.

Budgeted Amount

The estimated financial performance or financial position for a specific period based on expected revenues, expenses, assets, or liabilities.

Variable Overhead

Costs that fluctuate with the level of production or activity, such as utilities and raw materials expenditures.

Q3: If newly issued debt is issued from

Q18: The Town of Portsmouth has at the

Q43: Car Corp. (a U.S.-based company) sold parts

Q45: For a foreign subsidiary that uses the

Q64: On January 1, 2011, Pride, Inc. acquired

Q66: When consolidating a subsidiary that was acquired

Q67: The partnership of Rayne, Marin, and Fulton

Q81: Panton, Inc. acquired 18,000 shares of Glotfelty

Q90: On 4/1/09, Sey Mold Corporation acquired 100%

Q94: Esposito is an Italian subsidiary of a