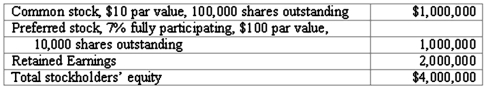

On January 1, 2011, Harrison Corporation spent $2,600,000 to acquire control over Involved, Inc. This price was based on paying $750,000 for 30 percent of Involved's preferred stock, and $1,850,000 for 80 percent of its outstanding common stock. As of the date of the acquisition, Involved's stockholders' equity accounts were as follows:

What is the total acquisition-date fair value of Involved?

Definitions:

Strike Price

The specified price at which an option contract can be exercised to buy or sell the underlying asset.

Call Option

A financial contract granting the buyer the right, but not the obligation, to purchase a stock, bond, commodity, or other asset at a specified price within a specific time period.

Call Option

A financial contract giving the buyer the right, but not the obligation, to buy a stock, bond, commodity, or other asset at a specified price within a specific time period.

Specified Price

The fixed price at which a transaction is agreed upon between a buyer and a seller.

Q12: Gargiulo Company, a 90% owned subsidiary of

Q27: The following information has been taken from

Q37: Which of the following statements is true

Q45: A new truck was ordered for the

Q67: The partnership of Rayne, Marin, and Fulton

Q73: When a U.S. company purchases parts from

Q76: Webb Company owns 90% of Jones Company.

Q85: Winston Corp., a U.S. company, had the

Q101: Denber Co. acquired 60% of the common

Q114: For an acquisition when the subsidiary retains