These questions are based on the following information and should be viewed as independent situations.

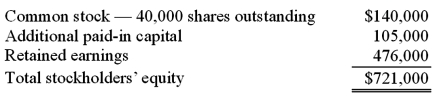

Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2009, when Cocker had the following stockholders' equity accounts.

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2012.

On January 1, 2012, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.

On January 1, 2012, Cocker issued 10,000 additional shares of common stock for $35 per share. Popper acquired 8,000 of these shares. How would this transaction affect the additional paid-in capital of the parent company?

Definitions:

Hierarchy of Effects

A framework outlining the steps a consumer takes, beginning with awareness and progressing through knowledge, appreciation, preference, conviction, to ultimately making a purchase.

Awareness

The state or level of consciousness where individuals or groups realize the existence or importance of something.

Consumer's Ability

The capacity of a consumer to make informed, effective, and efficient choices about the use of resources.

Product Brand

The identity given to a specific product or range of products by its manufacturer through branding.

Q1: Dancey, Reese, Newman, and Jahn were partners

Q10: Jones College, a public institution of higher

Q13: Webb Company owns 90% of Jones Company.

Q13: What are the three broad sections of

Q18: Pell Company acquires 80% of Demers Company

Q30: Pell Company acquires 80% of Demers Company

Q32: In a transaction accounted for using the

Q37: Stark Company, a 90% owned subsidiary of

Q65: According to GASB Concepts Statement No. 1,

Q85: Winston Corp., a U.S. company, had the