On January 1, 2011, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired.

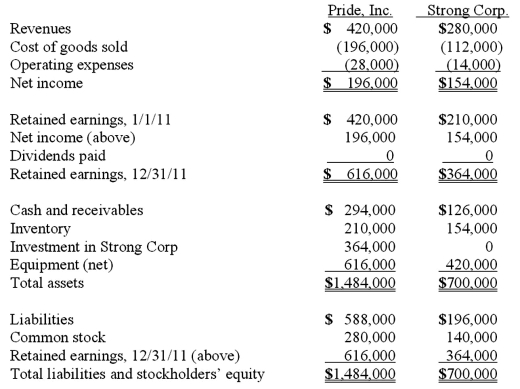

As of December 31, 2011, before preparing the consolidated worksheet, the financial statements appeared as follows:

During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

What is the total of consolidated operating expenses?

Definitions:

Optimistic Future

A hopeful outlook towards future events, believing in positive outcomes.

Sincere

Sincere describes a quality of being genuine, honest, and free from pretense or deceit in one's actions or expressions.

Uncertain Conclusions

Outcomes or findings that are not definitive or clear, often due to insufficient evidence or complexity.

Negative News

Reports or announcements that convey adverse or unwelcome information, often impacting public perception or sentiment.

Q31: What factors create a foreign exchange gain?

Q34: Under the temporal method, property, plant &

Q38: Perry Company acquires 100% of the stock

Q56: Strickland Company sells inventory to its parent,

Q57: What is a safe cash payment?

Q78: Pell Company acquires 80% of Demers Company

Q86: Gentry Inc. acquired 100% of Gaspard Farms

Q89: In translating a foreign subsidiary's financial statements,

Q93: Kennedy Company acquired all of the outstanding

Q94: Walsh Company sells inventory to its subsidiary,