On January 1, 2011, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired.

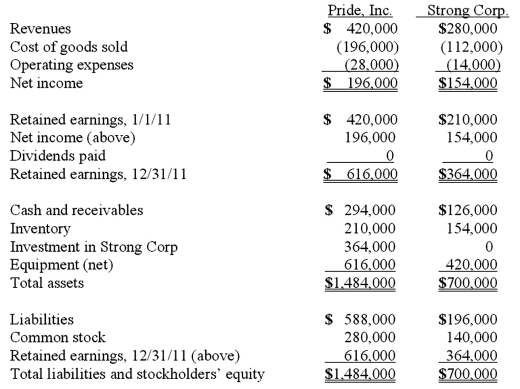

As of December 31, 2011, before preparing the consolidated worksheet, the financial statements appeared as follows:

During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

What is the consolidated total for inventory at December 31, 2011?

Definitions:

Offering Size

The total value or amount of securities, such as stocks or bonds, that are made available for sale in a public offering.

Gross Proceeds

The total amount of money received from a transaction before any deductions or expenses are subtracted.

Direct Private Long-term Debt Financing

A method of funding where companies borrow money directly from lenders on a long-term basis without public issuance through financial markets.

Public Issues

Refers to the offering of securities, like stocks or bonds, to the public to raise capital.

Q7: Chapel Hill Company had common stock of

Q22: Watkins, Inc. acquires all of the outstanding

Q30: Which of the following statements is true

Q38: The capital account balances for Donald &

Q45: Coyote Corp. (a U.S. company in Texas)

Q46: Bullen Inc. acquired 100% of the voting

Q57: What is a safe cash payment?

Q60: When a company has preferred stock in

Q74: Withdrawals from the partnership capital accounts are

Q109: Panton, Inc. acquired 18,000 shares of Glotfelty