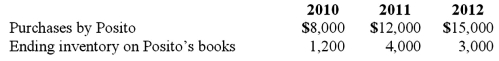

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2010 consolidation worksheet entry with regard to the unrealized gross profit of the 2010 intra-entity transfer of merchandise?

Definitions:

Indifference Curves

Graphs representing combinations of goods among which a consumer is indifferent, showing trade-offs in consumption preferences.

Marginal Utility

The extra pleasure or advantage obtained from using an additional unit of a product or service.

Total Utility

The total satisfaction received from consuming a given total quantity of a good or service.

Clothing

Clothing refers to items worn on the body, typically made from fabrics or textiles, but can include garments made from animal skin or other thin sheets of materials put together, serving to protect, adorn, or fulfill social and cultural expressions.

Q3: A foreign subsidiary was acquired on January

Q18: Which item is not shown on the

Q33: For an acquisition when the subsidiary maintains

Q34: On January 1, 20X1, the Moody Company

Q40: Acker Inc. bought 40% of Howell Co.

Q41: On November 8, 2011, Power Corp. sold

Q57: On January 1, 2011, Jackie Corp. purchased

Q96: How should a permanent loss in value

Q114: These questions are based on the following

Q118: Watkins, Inc. acquires all of the outstanding