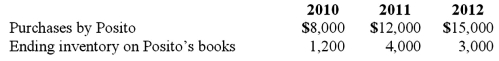

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2010 consolidation worksheet entry with regard to the unrealized gross profit of the 2010 intra-entity transfer of merchandise?

Definitions:

Dividends Paid

The portion of a company's earnings distributed to shareholders, usually on a regular basis.

Operating Expenses

The costs related to the day-to-day operations of a business, excluding cost of goods sold.

Cost of Goods Sold

The total cost of manufacturing or purchasing the goods a company has sold during a period.

Taxable Income

The portion of individual or corporate income subject to taxation, after all deductions and exemptions.

Q8: Certain balance sheet accounts of a foreign

Q28: Carnes has the following account balances as

Q33: For an acquisition when the subsidiary maintains

Q39: Parsons Company acquired 90% of Roxy Company

Q47: Coyote Corp. (a U.S. company in Texas)

Q49: According to GAAP regarding amortization of goodwill

Q94: For each of the following situations, select

Q97: Stark Company, a 90% owned subsidiary of

Q103: How is contingent consideration accounted for in

Q107: Hoyt Corporation agreed to the following terms