On January 1, 2009, Vacker Co. acquired 70% of Carper Inc. by paying $650,000. This included a $20,000 control premium. Carper reported common stock on that date of $420,000 with retained earnings of $252,000. A building was undervalued in the company's financial records by $28,000. This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized and amortized over 20 years.

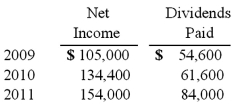

Carper earned income and paid cash dividends as follows:

On December 31, 2011, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.

Required:

If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2011?

Definitions:

Reinforcement

In behavioral psychology, it refers to any stimulus which strengthens or increases the probability of a specific response.

Positive Reinforcer

A stimulus that, when presented after a behavior, increases the likelihood of that behavior being repeated.

Negative Reinforcer

A stimulus whose removal or avoidance after a response strengthens that response or makes it more likely to happen again.

Conditioned Stimulus

A previously neutral stimulus that, after becoming associated with an unconditioned stimulus, evokes a conditioned response in classical conditioning.

Q40: Perry Company acquires 100% of the stock

Q42: Which of the following statements is true

Q50: The main practical problem associated with building

Q51: Presented below are the financial balances for

Q55: Bullen Inc. acquired 100% of the voting

Q55: What would differ between a statement of

Q57: On January 1, 2011, Jackie Corp. purchased

Q62: Given that our galaxy has a volume

Q97: On January 1, 2010, Jannison Inc. acquired

Q120: Watkins, Inc. acquires all of the outstanding