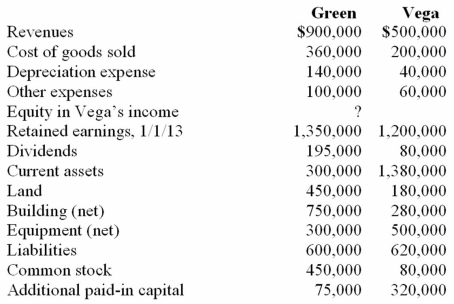

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the book value of Vega at January 1, 2009.

Definitions:

Personal Profile

A collection of personal data associated with a specific user, often used for identification, personalization, or targeted marketing.

Facebook Page

A public profile on Facebook specifically created for businesses, organizations, celebrities, and brands to share information, updates, and engage with their audience.

Advertising

Any paid form of nonpersonal communication about an organization, product, service, or idea by an identified sponsor.

Business-oriented

An approach or mindset focused on achieving business objectives, often emphasizing efficiency, profitability, and market competitiveness.

Q9: The mass ratio of a rocket is

Q17: What kind of message from Earth was

Q42: Stiller Company, an 80% owned subsidiary of

Q57: Royce Co. acquired 60% of Park Co.

Q63: Presented below are the financial balances for

Q67: Perry Company acquires 100% of the stock

Q78: Parent Corporation had just purchased some of

Q83: Perch Co. acquired 80% of the common

Q105: Factors that should be considered in determining

Q113: What is the purpose of the adjustments