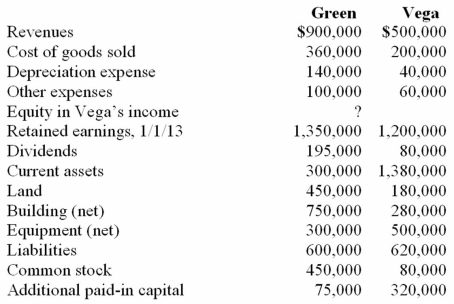

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated total expenses.

Definitions:

Leverage

Utilizing borrowed capital to amplify the possible gains from an investment.

Interest Rate

The percentage of a sum of money charged for its use, typically expressed on an annual basis.

All Equity

A financing structure where a company's capital structure is composed entirely of equity without any debt.

Repurchase Shares

The action taken by a company to buy back its own shares from the marketplace, reducing the amount of outstanding stock.

Q5: When an electron collides with a positron

Q9: What is the most common class of

Q14: Carnes has the following account balances as

Q28: According to Einstein's Special Theory of Relativity,

Q76: Gargiulo Company, a 90% owned subsidiary of

Q77: In a situation where the investor exercises

Q78: On January 4, 2011, Mason Co. purchased

Q79: Which of the following statements is true

Q81: Gargiulo Company, a 90% owned subsidiary of

Q112: Kaye Company acquired 100% of Fiore Company