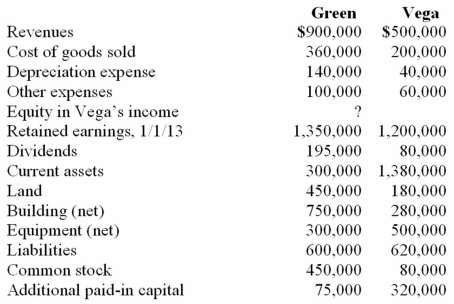

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated equipment.

Definitions:

Advertising Expense

Costs incurred in promoting products, services, or the brand as a whole, typically classified as operating expenses on the income statement.

Gross Sales

The total sales generated by a business before any deductions are made for returns, allowances, and discounts.

Indirect Advertising Expenses

Costs not directly associated with specific advertising campaigns but related to broader promotional activities, such as salaries of marketing staff or general promotional materials.

Gross Sales

The total sales amount without any deductions for discounts or returns.

Q5: On January 2, 2011, Heinreich Co. paid

Q26: How would consolidated earnings per share be

Q28: Car Corp. (a U.S.-based company) sold parts

Q31: A Lagrange point in the Earth-Moon system

Q48: How do subsidiary stock warrants outstanding affect

Q80: Pell Company acquires 80% of Demers Company

Q84: On January 1, 2009, Vacker Co. acquired

Q109: On January 3, 2011, Austin Corp. purchased

Q110: Acquired in-process research and development is considered

Q116: On January 1, 2010, Mehan, Incorporated purchased