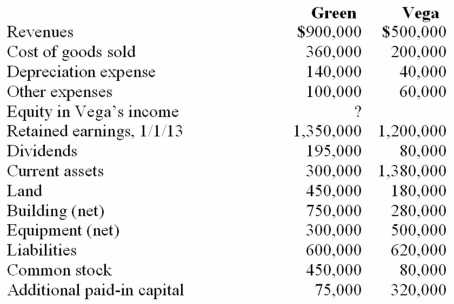

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated land.

Definitions:

Fixed Assets

Long-term tangible assets, such as buildings, machinery, and equipment, that a company uses in its operations and is not expected to consume or sell within a year.

Long-Term Solvency

A measure of a company's ability to meet its long-term financial obligations and continue its operations into the foreseeable future.

Notes to The Financial Statements

A detailed part of a company's financial statements that explains the context, accounting policies, and additional details of the financial figures reported.

Required Disclosures

Information that organizations are legally obligated to make available to stakeholders, often relating to financial, operational, or ethical matters.

Q5: Car Corp. (a U.S.-based company) sold parts

Q11: Why are radio waves probably the most

Q17: Pritchett Company recently acquired three businesses, recognizing

Q20: Kaye Company acquired 100% of Fiore Company

Q40: Acker Inc. bought 40% of Howell Co.

Q59: In a transaction accounted for using the

Q72: If a star has an extrasolar planet,

Q79: Car Corp. (a U.S.-based company) sold parts

Q89: Pell Company acquires 80% of Demers Company

Q110: Stevens Company has had bonds payable of