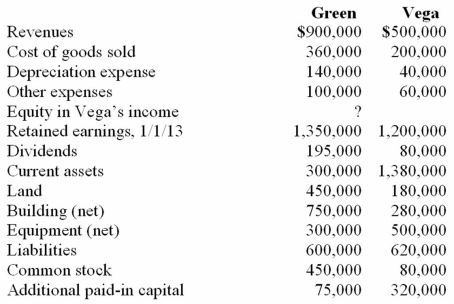

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated trademark.

Definitions:

Legal Opinions

Formal statements by a qualified legal expert concerning the legal status or interpretation of a matter.

Walling Off

The practice of segregating or isolating certain information or individuals within a firm to prevent conflicts of interest.

Conflict of Interest

A situation in which a person or entity has competing interests or loyalties that could potentially influence the objectivity of their decisions or actions.

Password Protection

A security measure where access to a device or digital resource requires entering a secret word or phrase.

Q3: When is the gain on an intra-entity

Q4: Winston Corp., a U.S. company, had the

Q11: Watkins, Inc. acquires all of the outstanding

Q31: Pell Company acquires 80% of Demers Company

Q33: Which of the following stars is the

Q45: Coyote Corp. (a U.S. company in Texas)

Q71: On January 1, 2011, Musial Corp. sold

Q75: Woolsey Corporation, a U.S. company, expects to

Q77: In a situation where the investor exercises

Q105: Which of the following is not an