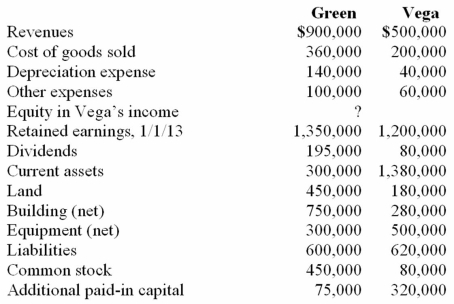

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013 consolidated retained earnings.

Definitions:

Profitability

measures how much profit or financial gain is generated as a percentage of the revenue of a company or business segment.

Liquidity

The simplicity of transforming an asset into cash without influencing its market value.

Statement of Cash Flows

A financial report that shows how changes in the balance sheet and income affect cash and cash equivalents, and breaks down financing, investing, and operating activities.

Stock Split

An increase in the number of shares of a company's stock without changing the shareholders' equity, typically done to lower the trading price of the stock.

Q9: On January 1, 2009, Nichols Company acquired

Q13: How is the fair value allocation of

Q23: When an electron collides with a positron

Q33: Thomas Inc. had the following stockholders' equity

Q45: Presented below are the financial balances for

Q59: Acker Inc. bought 40% of Howell Co.

Q70: An organism with an Encephalization Quotient (EQ)

Q103: Cayman Inc. bought 30% of Maya Company

Q107: How would you determine the amount of

Q118: Bullen Inc. acquired 100% of the voting