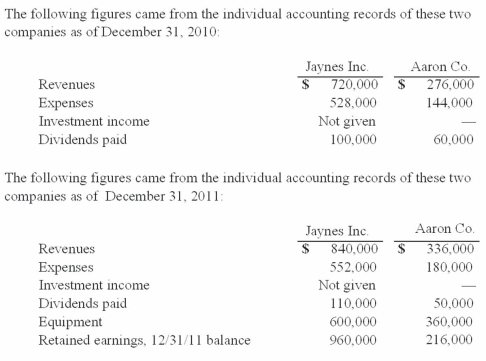

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What was consolidated net income for the year ended December 31, 2011?

Definitions:

Eka-Aluminum

A historical name for gallium, predicted by Mendeleev using his periodic table before it was discovered, exhibiting similar properties to aluminum.

Gallium

A soft, silvery metal that is used in electronics, such as semiconductors, due to its unique melting properties.

Eka-Silicon

Historically used term to describe an element predicted to exist by Mendeleev's periodic table and later identified as Germanium (Ge).

Germanium

A chemical element with the symbol Ge, used as a semiconductor in electronic devices.

Q2: Several years ago Polar Inc. acquired an

Q11: Pell Company acquires 80% of Demers Company

Q25: The antimatter equivalent of an electron is

Q52: Under the partial equity method of accounting

Q66: On January 1, 2011, Race Corp. acquired

Q73: On January 4, 2011, Mason Co. purchased

Q80: When we measure the mass of a

Q87: Allen Co. held 80% of the common

Q102: The balance sheets of Butler, Inc. and

Q104: On January 1, 2011, Pride, Inc. acquired