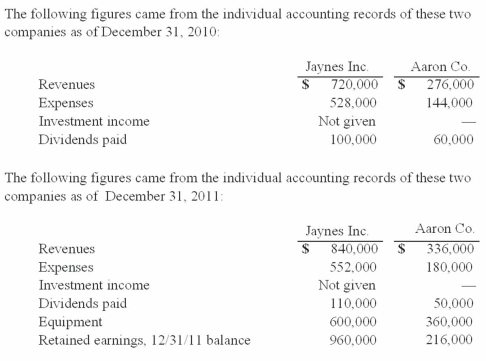

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What was consolidated equipment as of December 31, 2011?

Definitions:

Nerve Growth Factor

A protein essential for the growth, maintenance, and survival of certain neurons, playing a crucial role in the development and regeneration of the nervous system.

Dendritic Growth

The process by which neurons grow dendrites, the branch-like extensions that enable connections with other neurons for the transmission of information.

Stroke

A medical condition caused by the interruption of blood flow to the brain, resulting in cell death and potentially leading to significant physical and cognitive impairments.

Neurons

Electrically excitable cells that process and transmit information through electrical and chemical signals, serving as the basic unit of the nervous system.

Q2: Most of the carbon dioxide on the

Q15: McGuire Company acquired 90 percent of Hogan

Q17: On January 3, 2011, Roberts Company purchased

Q22: On January 1, 2011, John Doe Enterprises

Q38: Thomas Inc. had the following stockholders' equity

Q40: The wavelengths of radiation from a star

Q42: These questions are based on the following

Q62: On January 1, 2011, Riney Co. owned

Q88: Flynn acquires 100 percent of the outstanding

Q97: On January 1, 2011, Bast Co. had