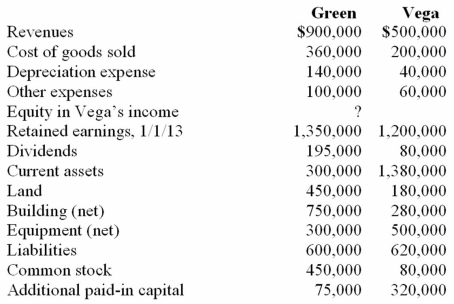

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the book value of Vega at January 1, 2009.

Definitions:

Standard Deviation

An indicator used to determine the extent of variation or dissimilarity within a group of values.

Data

Material compiled for consulting or investigative purposes.

Sum of Squared Scores

A calculation in statistics that measures the dispersion of a set of values by squaring each distance from the mean and summing them up, often used in variance and standard deviation calculations.

Data

Collected factual material, usually numeric, that serves as a basis for reasoning, discussion, or calculation.

Q10: On January 4, 2010, Trycker, Inc. acquired

Q11: Aqua Corp. purchased 30% of the common

Q19: The financial balances for the Atwood Company

Q28: Steven Company owns 40% of the outstanding

Q35: You are auditing a company that owns

Q37: Stark Company, a 90% owned subsidiary of

Q49: The most fundamental property of star is

Q51: Watkins, Inc. acquires all of the outstanding

Q65: Goehler, Inc. acquires all of the voting

Q105: When a subsidiary is acquired sometime after