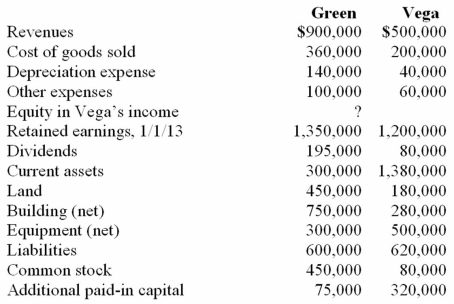

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated total expenses.

Definitions:

Default Risk

The risk that a borrower fails to make the required payments on their debt obligation.

Canada Call Feature

A special feature on certain bonds that allows the issuer to redeem the bond before maturity in the Canadian market.

Maturity

Maturity indicates the date on which the principal amount of a financial instrument is due to be paid back.

Buyback Price

Buyback price is the price at which a company agrees to repurchase its own shares from shareholders, often as part of a share repurchase program.

Q14: Skipen Corp. had the following stockholders' equity

Q25: Intelligence may be subject to convergent evolution

Q35: You are auditing a company that owns

Q41: Under the equity method of accounting for

Q60: Yoderly Co., a wholly owned subsidiary of

Q67: McLaughlin, Inc. acquires 70 percent of Ellis

Q80: Parent Corporation loaned money to its subsidiary

Q86: When applying the equity method, how is

Q114: For an acquisition when the subsidiary retains

Q115: Which of the following statements is false