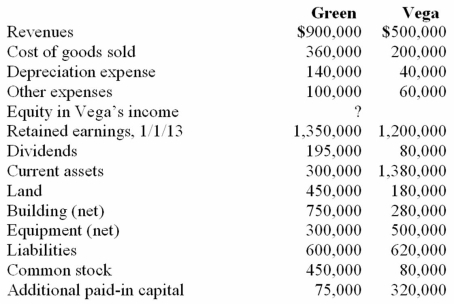

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated additional paid-in capital.

Definitions:

Equity Accounted Balance

A method of accounting whereby an investor recognizes its share of the profits and losses of its investee within its own financial statements.

Profit/(Loss)

The financial result of an entity's operations and activities, indicating income or deficit over a specific period.

Equity Method

An accounting technique used to record investments in other companies by recognizing the investor's share of the earnings of the investee.

Non-current Assets

Assets that are intended for use over a long-term period, usually more than one year, such as property, plant, and equipment.

Q3: The ultimate speed of a solar-sail-propelled spacecraft

Q5: Which of the following types of stars

Q32: Fargus Corporation owned 51% of the voting

Q32: A U.S. company buys merchandise from a

Q54: Kordel Inc. acquired 75% of the outstanding

Q58: The 1420 MHz (21 cm) radio line

Q73: Webb Company owns 90% of Jones Company.

Q78: Pell Company acquires 80% of Demers Company

Q104: Which of the following results in a

Q118: Stiller Company, an 80% owned subsidiary of