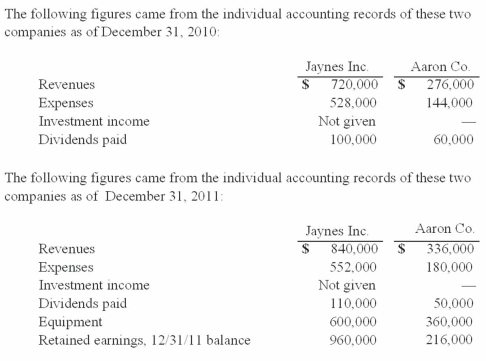

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What was consolidated equipment as of December 31, 2011?

Definitions:

Real Wages

The purchasing power of wages, quantifying the amount of goods and services that can be bought, accounting for inflation.

Nominal Wages

Wages paid to workers measured in current money, without adjusting for inflation or purchasing power.

Annual Rate

An interest rate calculated for a period of one year, often expressed as a percentage.

Real Wage

The purchasing power of a worker's earnings, adjusted for inflation, reflecting the true value of goods and services that can be bought.

Q12: The organisms with the highest Encephalization Quotient

Q15: Europa is located outside the Sun's habitable

Q18: Harrison, Inc. acquires 100% of the voting

Q23: What is the minimum value of N

Q24: If we accelerate a radioactive isotope of

Q33: On the basis of the scientific method,

Q48: On January 1, 2010, Smeder Company, an

Q49: The most fundamental property of star is

Q76: The third planet discovered around the star

Q85: The following information has been taken from