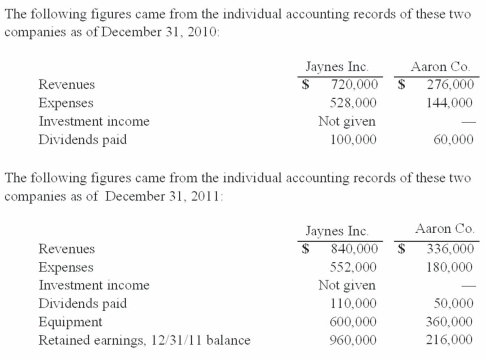

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What was the total for consolidated patents as of December 31, 2011?

Definitions:

Federal Government

The national level of government, having supreme authority over political units like states or provinces, responsible for the execution of national laws and policies.

Central Government

The national or federal government, responsible for the administration and governance of a country as a whole.

Convention in Philadelphia

The Convention in Philadelphia, also known as the Constitutional Convention of 1787, was a meeting where the Constitution of the United States was drafted to replace the Articles of Confederation.

Rhode Island

The smallest U.S. state by area, known for its sandy shores and seaside colonial towns. It played a significant role in the American Revolution.

Q12: Nuclear fission is the process by which<br>A)

Q18: Pell Company acquires 80% of Demers Company

Q39: Parsons Company acquired 90% of Roxy Company

Q48: How do subsidiary stock warrants outstanding affect

Q59: Acker Inc. bought 40% of Howell Co.

Q76: Encephalization Quotient (EQ) values can be estimated

Q77: In a situation where the investor exercises

Q92: A- and F-type stars<br>A) do not contain

Q94: Walsh Company sells inventory to its subsidiary,

Q110: Acquired in-process research and development is considered