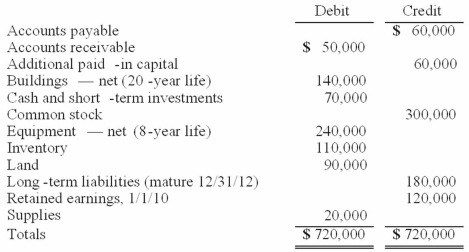

Matthews Co. acquired all of the common stock of Jackson Co. on January 1, 2010. As of that date, Jackson had the following trial balance:

During 2010, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2011, Jackson reported net income of $132,000 while paying dividends of $36,000.

Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2010, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.

Matthews decided to use the equity method for this investment.

Required:

(A.) Prepare consolidation worksheet entries for December 31, 2010.

(B.) Prepare consolidation worksheet entries for December 31, 2011.

Definitions:

Sentiment Analysis

A method in data analysis that identifies and categorizes opinions or emotions within text data to determine the writer's or speaker's attitude towards a particular topic.

Coverage Error

A statistical error that occurs when some members of the target population are not adequately represented in the sample.

Echo Effect

The phenomenon where information, ideas, or beliefs are reinforced through repetition within a closed system, limiting exposure to diverse viewpoints.

Nonresponse Error

An error that occurs in survey research when individuals selected for the sample do not respond, potentially biasing the results.

Q13: The decrease in infrared emission observed when

Q27: The following information has been taken from

Q40: Wilson owned equipment with an estimated life

Q46: Perry Company acquires 100% of the stock

Q67: McLaughlin, Inc. acquires 70 percent of Ellis

Q67: An intra-entity sale took place whereby the

Q78: Which of the following statements is false

Q78: Parent Corporation had just purchased some of

Q79: Which of the following statements is true

Q90: Parker owned all of Odom Inc. Although