On January 1, 2009, Rand Corp. issued shares of its common stock to acquire all of the outstanding common stock of Spaulding Inc. Spaulding's book value was only $140,000 at the time, but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share. Rand was willing to convey these shares because it felt that buildings (ten-year life) were undervalued on Spaulding's records by $60,000 while equipment (five-year life) was undervalued by $25,000. Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill.

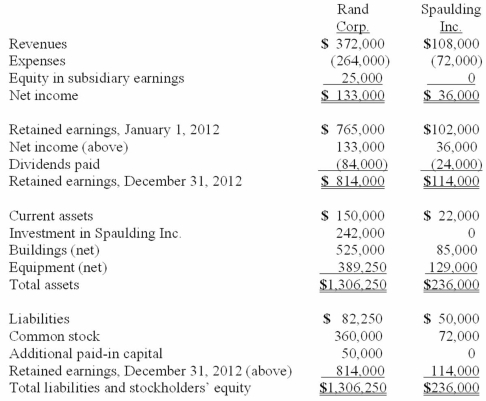

Following are the individual financial records for these two companies for the year ended December 31, 2012.

Required:

Prepare a consolidation worksheet for this business combination.

Definitions:

Market Rate

The prevailing interest rate available in the marketplace for instruments of similar risk and maturity.

Down Payment

An initial payment made when something is bought on credit.

Successful-efforts Method

An accounting method used in the oil and gas industry where costs are capitalized only if successful discoveries are made.

Full-cost Method

Accounting practice where all direct and indirect fixed and variable costs are allocated to inventory until the products are sold.

Q6: Even though M-stars have very narrow habitable

Q25: Coyote Corp. (a U.S. company in Texas)

Q26: How would consolidated earnings per share be

Q33: Thomas Inc. had the following stockholders' equity

Q40: What is meant by the spot rate?

Q50: Pell Company acquires 80% of Demers Company

Q51: Regency Corp. recently acquired $500,000 of the

Q52: The theory of relativity predicts that everything

Q57: On January 1, 2011, Jackie Corp. purchased

Q99: Consolidated net income using the equity method