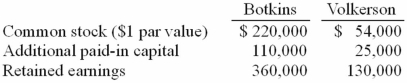

Prior to being united in a business combination, Botkins Inc. and Volkerson Corp. had the following stockholders' equity figures:

Botkins issued 56,000 new shares of its common stock valued at $3.25 per share for all of the outstanding stock of Volkerson.

Assume that Botkins acquired Volkerson on January 1, 2010. At what amount did Botkins record the investment in Volkerson?

Definitions:

Recipient

An individual or organization that receives something from another entity, often within the context of transactions or awards.

Charitable Entity

An organization established for philanthropic rather than profit-making purposes, benefiting the public or a particular social cause.

Cash Contributions

Monetary gifts made by individuals or organizations to entities such as companies, nonprofits, or trusts, often for specific purposes or projects.

Donated Goods

Items given to an organization at no cost, often recognized in the recipient's financial records as income or an asset.

Q5: One company buys a controlling interest in

Q9: Even though low luminosity stars have narrow

Q22: For each of the following situations (1

Q28: How does a parent company account for

Q29: On April 7, 2011, Pate Corp. sold

Q54: When an investor sells shares of its

Q71: The financial balances for the Atwood Company

Q92: Keenan Company has had bonds payable of

Q112: Stark Company, a 90% owned subsidiary of

Q126: Walsh Company sells inventory to its subsidiary,