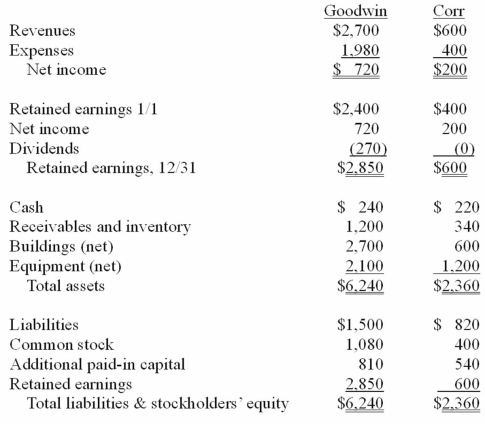

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated cash account at December 31, 20X1.

Definitions:

Directional Selection

A type of natural selection that favors individuals at one extreme end of the phenotypic range, leading to a shift in a population's genetic variance over time.

Pesticide-Resistant

Refers to the ability of pests to withstand chemical treatments designed to kill or control them, often due to genetic mutations and selection pressure.

Cladogram

Evolutionary tree diagram that visually summarizes a hypothesis about how a group of clades are related.

Cladogram

A diagram used in cladistics which shows relations among organisms based on shared derived characteristics.

Q24: Red Co. acquired 100% of Green, Inc.

Q26: In measuring non-controlling interest at the date

Q38: Stars much more luminous than the Sun

Q47: In principle, the Drake equation should enable

Q68: Pursley, Inc. acquires 10% of Ritz Corporation

Q71: Perry Company acquires 100% of the stock

Q74: MacDonald, Inc. owns 80 percent of the

Q84: On January 1, 2009, Vacker Co. acquired

Q86: When applying the equity method, how is

Q104: When a parent uses the acquisition method