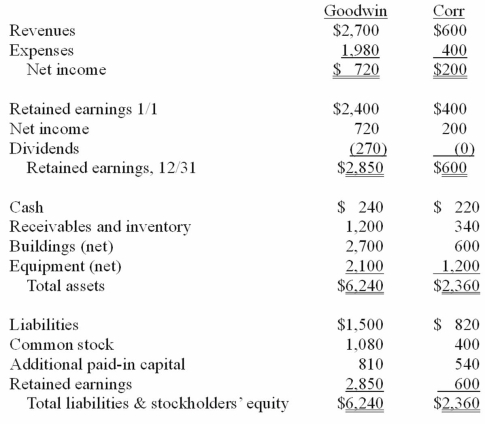

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated buildings (net) account at December 31, 20X1.

Definitions:

Adult Children

Individuals who are legally adults but may still depend on their parents emotionally or financially.

Career Goals

Personal objectives related to one's profession, including attained positions, achievements, or accomplishments desired in one's career path.

Middle-Aged Adults

Individuals roughly between the ages of 40 and 65, often experiencing significant life transitions and health changes.

Hoped-For Selves

Conceptual identities or versions of oneself that an individual aspires to become in the future, embodying hopes, dreams, and goals.

Q3: Gaw Company owns 15% of the common

Q5: Strickland Company sells inventory to its parent,

Q16: Which of the following numbers is itself

Q20: Pepe, Incorporated acquired 60% of Devin Company

Q29: The idea that other civilizations are waiting

Q29: How would a change be made from

Q31: NASA's Kepler mission, launched in 2009, is

Q65: Pell Company acquires 80% of Demers Company

Q85: Virginia Corp. owned all of the voting

Q87: Allen Co. held 80% of the common