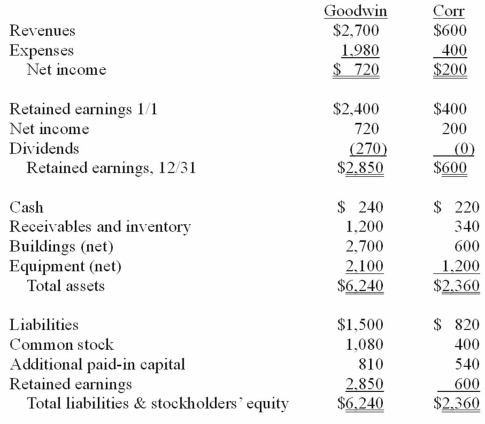

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated equipment (net) account at December 31, 20X1.

Definitions:

Contextual

Relating to, depending on, or influenced by the context or surroundings in which something exists or occurs.

Bildungsroman

A genre of novel that focuses on the psychological and moral growth of the protagonist from youth to adulthood.

German Philosophers

Intellectuals from Germany who have made significant contributions to philosophy, often associated with movements such as idealism, existentialism, and phenomenology.

Comedies

Works of literature, theater, or cinema that are intended to be humorous and entertain by highlighting the absurdities or peculiarities of life.

Q18: Flynn acquires 100 percent of the outstanding

Q42: Stiller Company, an 80% owned subsidiary of

Q45: Nuclear fusion is the process by which<br>A)

Q63: What mass ratio is required to launch

Q64: On January 1, 2011, Pride, Inc. acquired

Q65: Strayten Corp. is a wholly owned subsidiary

Q85: The following information has been taken from

Q88: On January 1, 2011, Musial Corp. sold

Q106: Ryan Company owns 80% of Chase Company.

Q114: Pot Co. holds 90% of the common