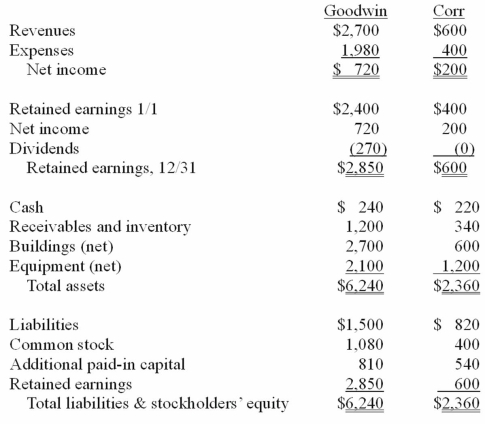

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consideration transferred for this acquisition at December 31, 20X1.

Definitions:

CSR Initiatives

Corporate Social Responsibility initiatives are actions taken by businesses to improve society or the environment beyond what is required by law.

Social Media

Digital platforms that enable users to create and share content or participate in social networking.

Engaging Consumers

The process of capturing the attention and interest of customers through various marketing and communication strategies to create a meaningful interaction.

Social Media Presence

The measure of how visible and active a brand or individual is on social media platforms.

Q13: All of the following would require use

Q21: Visible radiation may be useful for transmitting<br>A)

Q28: Fargus Corporation owned 51% of the voting

Q30: The ratio of an organism's brain weight

Q36: On January 1, 2010, Dawson, Incorporated, paid

Q38: Thomas Inc. had the following stockholders' equity

Q77: In a situation where the investor exercises

Q84: On January 4, 2010, Harley, Inc. acquired

Q85: Royce Co. acquired 60% of Park Co.

Q102: On January 3, 2011, Roberts Company purchased