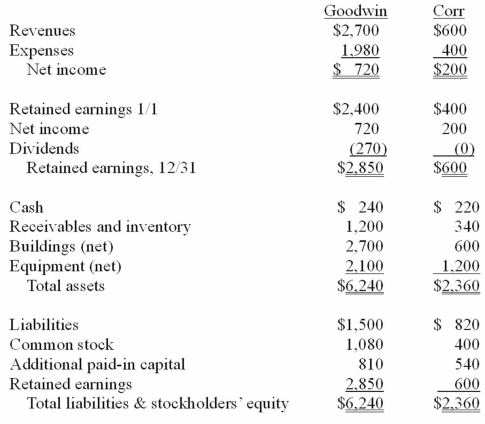

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated liabilities at December 31, 20X1.

Definitions:

Suffer

To experience or be subjected to something bad or unpleasant.

Fundamental Beliefs

Core convictions or principles that are deeply held and guide an individual's or group's actions and perspectives.

Creed

A set of beliefs or aims that guide someone's actions.

Artificial Insemination

A fertility treatment method involving the direct insertion of sperm into a woman's uterus to facilitate pregnancy.

Q14: Webb Co. acquired 100% of Rand Inc.

Q19: A star more luminous than our Sun

Q38: Perry Company acquires 100% of the stock

Q44: Renfroe, Inc. acquires 10% of Stanley Corporation

Q47: The antimatter equivalent of a proton is

Q59: Panton, Inc. acquired 18,000 shares of Glotfelty

Q72: For an acquisition when the subsidiary retains

Q77: Parrett Corp. acquired one hundred percent of

Q78: Pell Company acquires 80% of Demers Company

Q90: On January 1, 2011, Deuce Inc. acquired