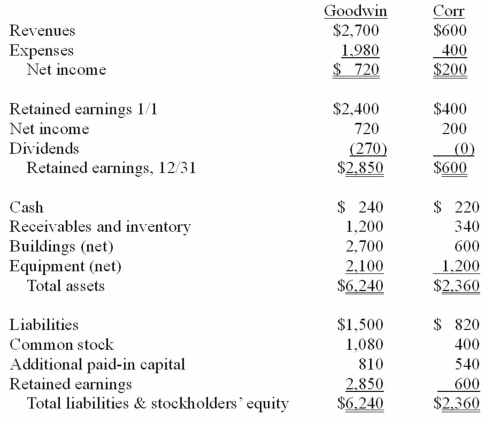

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated retained earnings at December 31, 20X1.

Definitions:

Units

In the context of inventory or production, refers to the individual items or components that can be counted or measured.

Break-Even Point

The point at which total costs and total revenue are equal, meaning no net loss or gain, and the business is breaking even.

Contribution Margin

The contribution margin represents the portion of sales revenue that is not consumed by variable costs and can contribute to covering fixed costs and generating profit.

Variable Cost

Costs that change in proportion to the level of production or sales activity.

Q3: One of the most likely places an

Q4: When an exoplanet passes behind its parent

Q34: Perch Co. acquired 80% of the common

Q36: On January 1, 2010, Jannison Inc. acquired

Q50: When a company applies the partial equity

Q54: Kordel Inc. acquired 75% of the outstanding

Q65: Pell Company acquires 80% of Demers Company

Q71: The financial balances for the Atwood Company

Q86: On January 1, 2009, Nichols Company acquired

Q94: Jet Corp. acquired all of the outstanding