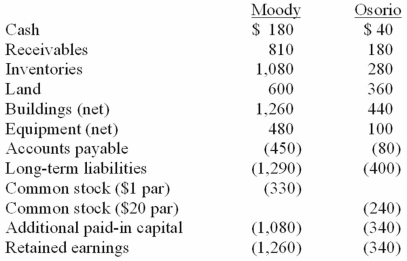

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

What amount was recorded as the investment in Osorio?

Definitions:

Melanin

is a pigment produced by melanocytes in the skin, determining skin and hair color and providing protection against UV radiation.

Keratinocytes

The primary type of cell found in the epidermis, responsible for producing keratin.

Adipose

Fat.

Mitotic Activity

The process and rate of cell division in which a single cell divides to produce two identical daughter cells.

Q8: The Drake equation allows us to estimate

Q16: Patti Company owns 80% of the common

Q16: According to GAAP, the pooling of interest

Q32: During the annihilation of matter and antimatter,

Q47: Fesler Inc. acquired all of the outstanding

Q55: What would differ between a statement of

Q56: Strickland Company sells inventory to its parent,

Q62: The Hertzprung-Russell diagram is a plot of<br>A)

Q80: Pell Company acquires 80% of Demers Company

Q85: Royce Co. acquired 60% of Park Co.