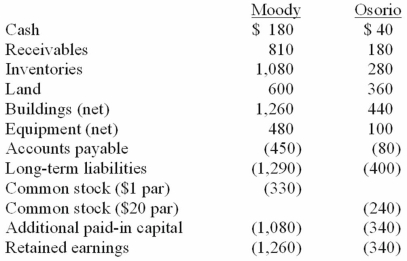

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated inventories at date of acquisition.

Definitions:

Nonverbal Cues

are the ways in which people communicate without the use of spoken words, including facial expressions, body language, gestures, and other forms of physical behavior.

Portrayed Himself

Describes how an individual represented or depicted themselves to others, often through behavior or presentation.

Memory Joggers

Tools or techniques used to aid and improve one's ability to remember information.

S-O-L-E-R

An acronym for a communication model emphasizing five key behaviors: Squarely face the person, Open posture, Lean towards the sender, Eye contact maintained, Relax while listening.

Q3: The ultimate speed of a solar-sail-propelled spacecraft

Q13: Over the past century, the largest increase

Q14: Carnes has the following account balances as

Q21: Mars currently lacks surface habitability mostly because

Q45: What is the definition of a star's

Q64: The maximum terminal velocity we could accelerate

Q69: Racer Corp. acquired all of the common

Q112: Stark Company, a 90% owned subsidiary of

Q116: Stark Company, a 90% owned subsidiary of

Q121: Wilson owned equipment with an estimated life