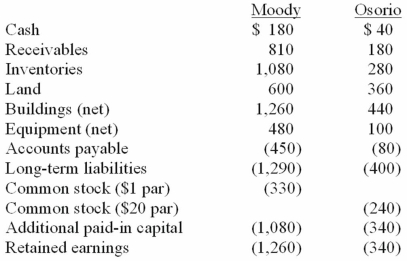

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated land at date of acquisition.

Definitions:

Substitutes

Products or services that can be used in place of one another, where an increase in the price of one leads to an increased demand for the other.

Complements

Goods or services that are used together, where an increase in the consumption of one leads to an increase in the consumption of the other.

Law of Supply

The principle that, other things equal, an increase in the price of a good leads to an increase in the quantity supplied, and vice versa.

Price

The amount of money required to purchase a good or service, representing the value that consumers or buyers are willing to pay.

Q1: Pell Company acquires 80% of Demers Company

Q7: Which one of the following accounts would

Q9: On January 2, 2010, Hull Corp. paid

Q38: Fine Co. issued its common stock in

Q39: Panton, Inc. acquired 18,000 shares of Glotfelty

Q45: A parent acquires all of a subsidiary's

Q47: Flynn acquires 100 percent of the outstanding

Q50: A subsidiary issues new shares of common

Q63: Dalton Corp. owned 70% of the outstanding

Q92: Keenan Company has had bonds payable of