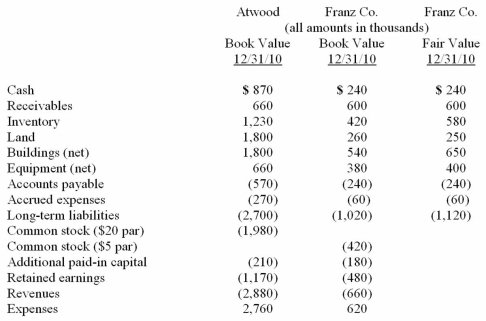

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated inventory at date of acquisition.

Definitions:

Tells

Behaviors or signs inadvertently shown by individuals, revealing their thoughts, feelings, or intentions, often used in the context of poker or psychology to detect deception.

Systems Dynamics

An approach to understanding the nonlinear behavior of complex systems over time using stocks, flows, internal feedback loops, and time delays.

Identifying

The process of recognizing or establishing the identity of something or someone.

Anticipating

The ability to predict or prepare for future events or needs in a proactive rather than reactive manner.

Q15: McGuire Company acquired 90 percent of Hogan

Q26: The following are preliminary financial statements for

Q45: What is the definition of a star's

Q72: For an acquisition when the subsidiary retains

Q85: Royce Co. acquired 60% of Park Co.

Q96: Stark Company, a 90% owned subsidiary of

Q96: Watkins, Inc. acquires all of the outstanding

Q98: Pepe, Incorporated acquired 60% of Devin Company

Q117: Tara Company owns 80 percent of the

Q121: Wilson owned equipment with an estimated life