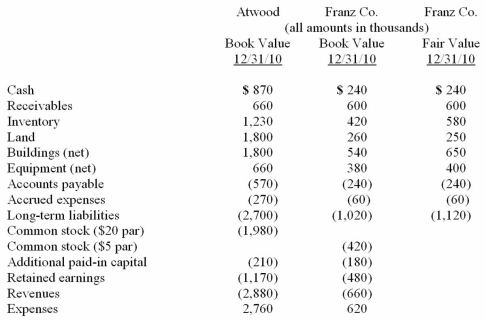

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated revenues at date of acquisition.

Definitions:

Physical Activity Goals

Targets or objectives set to increase or improve one’s level of physical activity for health benefits.

Physical Activity Myths

Misconceptions or false beliefs about exercise and physical activity that may prevent individuals from getting active or working out effectively.

LGBTQ

An acronym that stands for Lesbian, Gay, Bisexual, Transgender, and Queer, representing a community of individuals with diverse sexual orientations and gender identities.

Sexual Orientation

An individual's pattern of physical, romantic, and/or emotional attraction to others, based on their gender.

Q35: On January 1, 2010, Smeder Company, an

Q35: Apart from its distance from its parent

Q54: Kordel Inc. acquired 75% of the outstanding

Q55: Pell Company acquires 80% of Demers Company

Q57: If we are eventually able to detect

Q60: If we allow for a planet with

Q60: Yoderly Co., a wholly owned subsidiary of

Q69: Racer Corp. acquired all of the common

Q71: Femur Co. acquired 70% of the voting

Q95: Pell Company acquires 80% of Demers Company