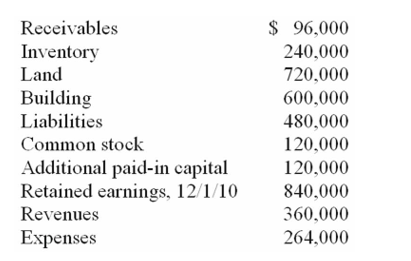

Jernigan Corp. had the following account balances at 12/1/10:

Several of Jernigan's accounts have fair values that differ from book value. The fair values are: Land - $480,000; Building - $720,000; Inventory - $336,000; and Liabilities - $396,000.

Inglewood Inc. acquired all of the outstanding common shares of Jernigan by issuing 20,000 shares of common stock having a $6 par value, but a $66 fair value. Stock issuance costs amounted to $12,000.

Required:

Prepare a fair value allocation and goodwill schedule at the date of the acquisition.

Definitions:

Consideration

Something of value exchanged between parties in a contract, making the agreement legally binding.

Adequacy of Consideration

An evaluation of whether the value exchanged between parties in a contract is reasonably fair at the time of the agreement.

Bargained-for Exchange

An essential principle of contract law involving the mutual exchange of promises or consideration between parties entering an agreement.

Legal Sufficiency

The adequacy of evidence or legal grounding in an agreement, claim, or defense that meets minimum legal standards to proceed or withstand scrutiny in a court of law.

Q2: The fact that many different organisms on

Q12: Gargiulo Company, a 90% owned subsidiary of

Q21: All of the following statements regarding the

Q23: Stiller Company, an 80% owned subsidiary of

Q25: The antimatter equivalent of an electron is

Q30: Which of the following extrasolar planets would

Q60: On January 1, 2010, Cale Corp. paid

Q84: On January 4, 2010, Harley, Inc. acquired

Q122: Harrison, Inc. acquires 100% of the voting

Q125: Walsh Company sells inventory to its subsidiary,